I have a very simple proposal to boost our high streets again.

Why not insist, or in other words force, legislate, that out of town supermarkets have to open a high street shop, where customers can get service on a limited number of items, and place on-line orders for next day delivery?

In addition supermarkets should fund as many free car parks spaces in the town as they have at their out of town location.

Sound fair doesn't it, that is if we want to rejuvenate our town centres.

Tuesday 20 December 2011

Sunday 18 December 2011

Shared debt and the ECB

So finally some sensible people are beginning to acknowledge that the euro issue cannot be solved by tough budgets.

No, the most urgent things are:

1 Sharing the debt. The euro countries cannot any more go their own way with Germany benefiting and Greece dying. There has to be shared debt burden and responsibility.

2 ECB as a lender of last resort. The ECB has to become the euro central bank, fully engaged in all the necessary banking activities that other central banks do.

Just those two simple things and the euro can become a valid currency. Without them it is just going to drag on and on, before eventual collapse.

No, the most urgent things are:

1 Sharing the debt. The euro countries cannot any more go their own way with Germany benefiting and Greece dying. There has to be shared debt burden and responsibility.

2 ECB as a lender of last resort. The ECB has to become the euro central bank, fully engaged in all the necessary banking activities that other central banks do.

Just those two simple things and the euro can become a valid currency. Without them it is just going to drag on and on, before eventual collapse.

Saturday 17 December 2011

Where does the economic problem lie?

Here's some thoughts

Globalisation. Which has undermined the manufacturing base in our economy, caused loss of jobs and falling living standards. It is USA & Europe versus China & India. But we brought it on ourselves by moving those jobs to Asia and giving them our technology!Government paralysis. Powerful interests prevent action on un-employment (freezing up of loans), inequality (poor incomes) & budget deficits (bond yields?). Our top income tax is too low, so their is not enough equality in society. Our banks are under-capitalised and un-regulated as we don't insist on either. Public investment is strangled and miss directed to structural spending not productive investment. The poor are asked to pay for the errors of the rich.

Politicians are in over their heads. They are arts graduates, not economists or technologists. So special interest groups move in and write the agenda. EU summits all fail politically and technically. The euro is being killed by incompetence.

No policy. The USA has miserably failed to produce any policies on any major item: budget, tax, energy, climate, financial regulation, healthcare or property. Europe is likewise lacking democratic policies that will work. The EU's 27 nations all await only Germany's proposals, which themselves are driven by a disaster of coalition politics, crippled banks, local interests and amateur politicians. The EU commission itself has no role and has done nothing. Treaties are pushed forwards with no debate, technical or political, the EU parliament is sidelined and has a huge democratic deficit as local parliaments hang onto power.

Fundamental problems. The two fundamental problems are inequality and poverty, these need active government policies of equality and inclusion. But current policies are trending to support the rich and penalise the poor. OUR money is being consistently sucked from us to fund casino banking. De-capitalised banks, through stupid investments of their own and central policy, fail. While Europe as a whole gets no focus on fiscal controls and central banking needs, while banks continue to worsen.

Despise Government. Perhaps the worst of all, as long as this goes on people will more and more despise Government and politicians on TV. They present no solutions. We need to make democracy work again, educate people to make decisions, present the options and ask them to decide. For our sake.

Thanks to the Guardian for stimulating me to write this.

Wednesday 14 December 2011

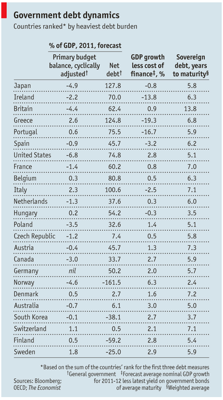

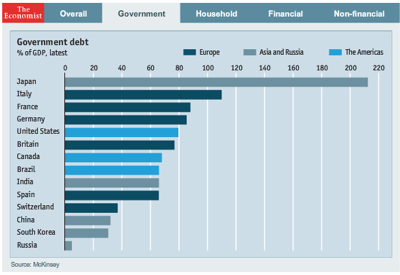

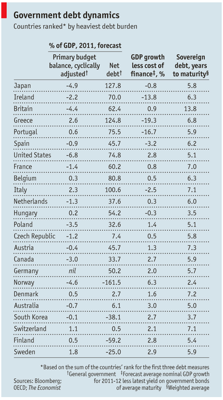

Time for some facts - euro mess

The BBC has published these charts, chosen by economists to show the situation we are in

This for me is the most interesting, as it is long term. As you can see Greece had a BIG cost of raising loans before the euro, during the euro just about everyone could borrow at the same rate - never mind their underlying fiscal position! Then after the bust everything went pear shaped and those that had borrowed more than they could possibly pay off have been hit with high interest rates - how stupid of them.

This for me is the most interesting, as it is long term. As you can see Greece had a BIG cost of raising loans before the euro, during the euro just about everyone could borrow at the same rate - never mind their underlying fiscal position! Then after the bust everything went pear shaped and those that had borrowed more than they could possibly pay off have been hit with high interest rates - how stupid of them.

And so now many countries are rapidly approaching the point where default will happen. And good luck to them when that does. The problem is they may take everyone else with them.

And so now many countries are rapidly approaching the point where default will happen. And good luck to them when that does. The problem is they may take everyone else with them.

The economy is tanking because households are not spending, in fact as we see below everyone is irrationally saving - or maybe it is because banks are charging too much interest - 20% on a credit card is much too much! Especially when the BOE rate is near zero.

The economy is tanking because households are not spending, in fact as we see below everyone is irrationally saving - or maybe it is because banks are charging too much interest - 20% on a credit card is much too much! Especially when the BOE rate is near zero.

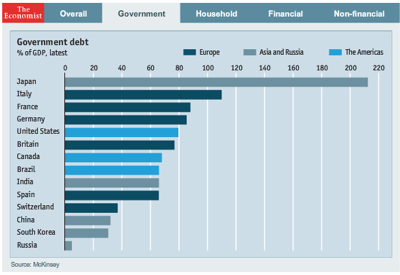

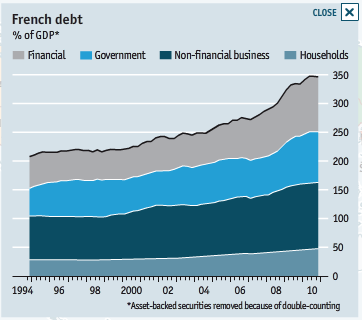

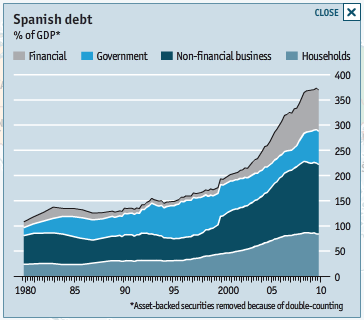

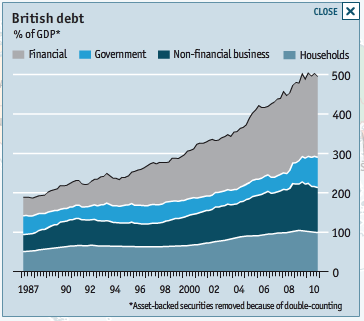

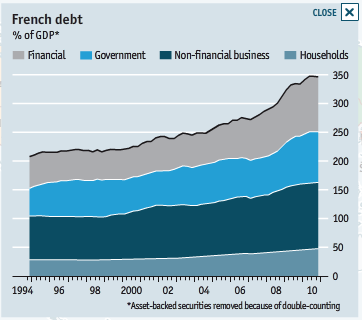

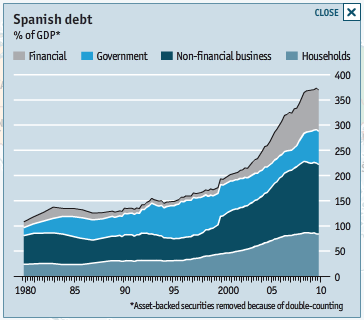

But the thing is, it's not government debt which is out of control, although it is bad enough because too much of it is expenses (health, social, education) not investment (roads, trains). Nor is it the finance companies. It is the households and non-financial companies that have huge debts.

But the thing is, it's not government debt which is out of control, although it is bad enough because too much of it is expenses (health, social, education) not investment (roads, trains). Nor is it the finance companies. It is the households and non-financial companies that have huge debts.

So why did Greece and the other go belly up? Relative labour costs! And lack of productivity. Unfortunately the UK is not on this chart, so it is finger pointing at the euro zone, but hey-ho it gives their game away.

So why did Greece and the other go belly up? Relative labour costs! And lack of productivity. Unfortunately the UK is not on this chart, so it is finger pointing at the euro zone, but hey-ho it gives their game away.

Last the relative competitiveness of different countries. The vertical column shows what the exchange rate should be against the euro plotted against the export growth which essential to survive. As you can see Germany has profited greatly by effectively having a too cheap currency and exporting greatly, whereas poor old Italy should have a lower currency and needs to do a whole lot better exporting.

Last the relative competitiveness of different countries. The vertical column shows what the exchange rate should be against the euro plotted against the export growth which essential to survive. As you can see Germany has profited greatly by effectively having a too cheap currency and exporting greatly, whereas poor old Italy should have a lower currency and needs to do a whole lot better exporting.

So there it is, now we just need everyone to get educated to read and understand these things so we can stop stupid political eurosceptic red-top paper headlines.

This for me is the most interesting, as it is long term. As you can see Greece had a BIG cost of raising loans before the euro, during the euro just about everyone could borrow at the same rate - never mind their underlying fiscal position! Then after the bust everything went pear shaped and those that had borrowed more than they could possibly pay off have been hit with high interest rates - how stupid of them.

This for me is the most interesting, as it is long term. As you can see Greece had a BIG cost of raising loans before the euro, during the euro just about everyone could borrow at the same rate - never mind their underlying fiscal position! Then after the bust everything went pear shaped and those that had borrowed more than they could possibly pay off have been hit with high interest rates - how stupid of them.

And so now many countries are rapidly approaching the point where default will happen. And good luck to them when that does. The problem is they may take everyone else with them.

And so now many countries are rapidly approaching the point where default will happen. And good luck to them when that does. The problem is they may take everyone else with them. The economy is tanking because households are not spending, in fact as we see below everyone is irrationally saving - or maybe it is because banks are charging too much interest - 20% on a credit card is much too much! Especially when the BOE rate is near zero.

The economy is tanking because households are not spending, in fact as we see below everyone is irrationally saving - or maybe it is because banks are charging too much interest - 20% on a credit card is much too much! Especially when the BOE rate is near zero.

But the thing is, it's not government debt which is out of control, although it is bad enough because too much of it is expenses (health, social, education) not investment (roads, trains). Nor is it the finance companies. It is the households and non-financial companies that have huge debts.

But the thing is, it's not government debt which is out of control, although it is bad enough because too much of it is expenses (health, social, education) not investment (roads, trains). Nor is it the finance companies. It is the households and non-financial companies that have huge debts. So why did Greece and the other go belly up? Relative labour costs! And lack of productivity. Unfortunately the UK is not on this chart, so it is finger pointing at the euro zone, but hey-ho it gives their game away.

So why did Greece and the other go belly up? Relative labour costs! And lack of productivity. Unfortunately the UK is not on this chart, so it is finger pointing at the euro zone, but hey-ho it gives their game away. Last the relative competitiveness of different countries. The vertical column shows what the exchange rate should be against the euro plotted against the export growth which essential to survive. As you can see Germany has profited greatly by effectively having a too cheap currency and exporting greatly, whereas poor old Italy should have a lower currency and needs to do a whole lot better exporting.

Last the relative competitiveness of different countries. The vertical column shows what the exchange rate should be against the euro plotted against the export growth which essential to survive. As you can see Germany has profited greatly by effectively having a too cheap currency and exporting greatly, whereas poor old Italy should have a lower currency and needs to do a whole lot better exporting.So there it is, now we just need everyone to get educated to read and understand these things so we can stop stupid political eurosceptic red-top paper headlines.

Tuesday 13 December 2011

Banks, vital?

Just a few numbers

Finance sector employs 1m people, add to that hangers on you get maybe 1.5m. 80% work in retail high street banks (a service industry).Manufacturing employs 2m people (productive industry)

Tax paid by finance sector (2002-9) was £193bn, but manufacturing paid £378bn

IMF says tax payers paid £289bn to prop up banks since 2008. Add in government underwriting and loans and you get £1.19tn

In 2007 40% of bank and BS lending was on property, 25% went to financial intermediaries. So 65% of lending went to pumping up the bubble

The City now pays more than 50% of Conservative party funds, up from 25% only 5 years ago.

So there we have it, dysfunctional capitalism.

And does anyone think we need less control of the banks?

If they will not redirect their activities to productive investment then they must be forced to do so, or pay the piper a Tobin Tax.Monday 12 December 2011

A new rage against the BBC and Flash

The BBC has closed its iPlayer site that allowed us to comment, question and complain about iPlayer,

But I have not forgotten one of the major complaints. The widespread use of Flash to distribute both sound and video. This is deeply embedded in the BBCs technology, and is deeply annoying for customers who have, rightly, turned they back on Flash and moved to the new open HTML 5 standard, 99% of users of which use H264 for video and AAC for audio. H264 by the way is a standard for video that is compatible across all platforms, it is used in mobile phones, tablets, digital TV, HD TV whereas Flash is closed an propriety and licensable if you want to use it...Why not HTML5/H264 for all versions of the iPlayer?

I cannot for the life of me why the BBC clings to the old Flash implementations of iPlayer. On the iPad it is streaming H264, but try to access it on your PC and you get Flash, which if like me you do not have Flash installed, means that I cannot view iPlayer on my MacBook..This is absurd. Maybe, just maybe, as they won't admit that this has been forced upon them by media companies scared of people copying programs, and re-distributing them on the Internet. But this is a silly argument, all programs are publicly broadcast, they can be recorded on DVRs and could then easily be transposed to H264 and put on the web. Moreover at least two companies (CatchupTV and FilmOn) are retransmitting live TV using iPad compatible video formats.

Another grouse. The BBC iPlayer app on the iPad does not allow video to be streamed to my TV via the small Apple TV box (which receives media by WiFi and outputs HDMI). Other companies regard this as a major advantage, to be able to offer their content on the Home TV (see TED and many others). In fact the stupidity is even worse, as my Sony TV has internet connectivity and a version of the BBC iPlayer on it, so I can get full screen viewing through this route, but why not from the iPad? The only problem is that my TV needs a wired Ethernet connection!! Not just WiFi. I object, no more wires!

The BBCs attitude just beggars belief, they have spent million on technology, but are way outside the trend. Time to catchup BBC.

As I see it now, the euro crisis

It has not gone away!

First, let's be clear UK did not exercise a "veto", if it had been a veto then the policy would not go ahead, at least not within the EU organisations… Cameron simply walked away. This leaves 26 countries to form a new EU group, with us on the outside. No one in their right mind could think this new group will not find a way to use the EU institutions (Council, Commission, ECB, Courts) to work for them… resulting in a constitutional crisis and working paralysis…Next, there is still no protection at all for our "financial industry" (remember the guys who got us in this mess in the first place…) as new finance regulations within the EU (of which remember we are a part) will be imposed by majority voting. This seems 100% certain as 26 of the 27 have expressed their intention of grouping together to solve the finance crisis.

Next, The Lib Dems are right. We need to be strong, and be inside the EU. We are, whether we like it or not a part of Europe, there's no where else for a small, broken country to go…

Next, the agreement may fix the deficit problems and agree the 3/60% rule by legal means - whatever the economic consequences for poor Greece and the others - probably this will create a severe depression…

But, they have not solved the debt problem. The huge sovereign and bank debts remain. The small bazooka of various funds will not cure the problem, as it is unbalanced unless a common euro bond is issued to balance all the countries in one group.

So, now let's see what happens next…

Sunday 11 December 2011

The UK problem

How on earth can UK be a strong member of the EU, creating and defining policies and governance, if we consistently stay out of it?

Conservative do not participate in the EU parliamentary party. We have separate and much ignored election of unknown EU politicians. We do not accept to transfer power to the EU parliament or the EU Commission, and live with EU management only through dictatorial power of the commission and democratic rubber stamping by the EU Council (heads of state meetings…). There has to be another way, it may be radical but we should get fully stuck-in and adopt a future that is European.

Conservative do not participate in the EU parliamentary party. We have separate and much ignored election of unknown EU politicians. We do not accept to transfer power to the EU parliament or the EU Commission, and live with EU management only through dictatorial power of the commission and democratic rubber stamping by the EU Council (heads of state meetings…). There has to be another way, it may be radical but we should get fully stuck-in and adopt a future that is European.

Two problems

Shake out.

One of the shake-outs from the big EU meeting last week was to delineate the TWO problems, only on of which has been addressed.1 Deficits. Without a doubt many EU countries have unacceptable and unsustainable deficits. These cannot be cured overnight, and as far as I know the meeting did not define a timescale for them to be fixed. Personally I think 20 years might be a good frame to think about.

2 Debt. Many big nations have huge debts, including the USA, and all of the EU. The problems of debt is borrowing, and the problem of borrowing is that lenders demand an interest on their money. And for many EU countries this interest is getting too large, as lenders are beginning to believe that debts may not be repaid and default could happen. In other words a country is in sovereign debt where its whole wealth is not enough to pay its debts, and it is continuously running up more by overspending.

Debt comes about only when lenders agree to lend to borrowers, both create the debt, both are responsible, this means the banks. Today EU banks carry too much debt, by lending to countries who increasingly can't pay. The question is how to get enough money to pay off the debts, as the countries cannot generate enough to do it, considering the interest that the loans demand. In the USA the FED simply prints more money, in UK the Bank of England (why not the Bank of UK?) gives money to banks called quantitive easing. But in the EU there is no bank to do this, the ECB charter does not allow it to do it as there is no central financial management.

So the question remains.

We have proposals to have a treaty to coordinate every countries budgets, to solve the first problem - expect for UK which walked away from the table. But for the second - where will the money come from that is urgently needed NOW - there is no solution.Saturday 10 December 2011

The Apple magic has gone?

I am feeling a bit down today.

Why? Because I have been reading blogs about Apple and its products, and I have even gone back to browsing their web site, and I am not moved to want anything new from them.No more magic? What could have happened?

Maybe it's just that the new iPhone 4S (which my son has, and I am not jealous) looks just the same as the iPhone 4 (which I have). Siri just makes me feel foolish, talking to a phone, indeed.Maybe its because I am a little underwhelmed with the performance and features of iCloud.

- OK so after a while my photos do appear in iPhoto, but only when I am on WiFi, I want them over 3G (I have an unlimited contract from "3", very good value!).

- My Pages docs do not sync to Pages on my MacBook (nor do Keynote or Numbers files).

- I will not have , after July 2012, a Mobile Me web site - that is a real negative.

- Having email that syncs across devices is not new, I had that years ago using IMAP technology, deleting an email on my iPhone or iPad deletes it on my MacBook before I have a chance to decide if I want to file it away…whoops, and I can't transfer files saved on my MacBook back to the iPad/iPhone, in fact I can't see my FILING folder at all.

Maybe it is because I see Apple as not responding to markets outside the USA in terms of product conception and performance offerings? They seem tied to the coat tails of AT&T in the features of the iPhone, whereas in Europe our networks are cheaper and more open.

Maybe because I simply don't believe they could get anywhere with a standard TV. They could perhaps make a better box like EyeTV (e.g. a receiver with WiFi output) , but there are so many world standards for TV distribution that I wonder if this could be possible? If they want to do everything over the internet, that's fine, but the network capacity in UK, at least, is not up to it, and the competition from BT (who, remember own the network!) is strong and maybe favoritised?

Maybe because they seem to not be getting their way with the media companies and studios in the way they used to when iTunes started. Their Movies, TV shows and Books all are behind the latest tends and studios still show films in cinemas first, then DVD then iTunes, by which time there is no more interest (that's why we have pirates). There is no excitement in the offering. You can't just keep flogging the Beatles!

I am becoming disappointed in my iPad (v 1.0) as Safari and now the new iBooks apps keep crashing back to the home screen, why? Is the focus on iPad 2 with not enough testing on the older iPad 1?

Maybe because the damned Samsung seem to be getting away with blatant stealing of Apple's IP, and copying the look and feel of the iPhone and iPad.

But I have to say that I am well content with OS10 Lion on my 4year old MacBook. I don't have track pad gestures, but otherwise it runs fine. A bit more processing power and memory (I am maxed out at 2GB) would help when I have 4-5 apps running in full screen. And I am truly annoyed at iPhoto not having an import capability in full screen mode!

I do hope Apple will regain their leadership and innovative idea-block they seem to be going through. They need a new market to revolutionise… TV could be one, but how without media cooperation? Low cost PC could be another (sort of iPad with keyboard) to finally knock some competitors out of the market (not innovative I know, but a better product)… HD audio, now there's a market waiting to happen, Apple could re-awaken everyone's appreciation of high quality audio (quality over quantity), knock a hole in Amazon's MP3 stuff, and awful offerings like Spotify streaming (quantity over quality approach). The could make a lot more of Airplay, bit getting more makers to implement it, raising the audio bar to transmit 24bit/96kHz audio, insisting that any app on iPad should be able to stream both audio and video (again this means getting the initiative back from media people, like the BBC whose iPlayer only streams audio to my Apple TV!).

Friday 9 December 2011

How is the UK doing?

Debts, debts debts

Deficit as a % of GDP. (EU Treaty limit is 3%)

Deficit as a % of GDP. (EU Treaty limit is 3%)

To fund it, the Government borrowed a monumental £170.8 billion last year. If all goes well, we're set to borrow another £167.9 billion this year. With government spending so far out of control, interest on the national debt will cost over £42 billion this year.

To fund it, the Government borrowed a monumental £170.8 billion last year. If all goes well, we're set to borrow another £167.9 billion this year. With government spending so far out of control, interest on the national debt will cost over £42 billion this year. This is who owns our debt. Currently just over 35% of our national debt is owed to foreign governments and investors. So it's not just Third World nations in hock to the rest of the world. We're relying on the confidence of foreign investors to keep our own country afloat. According to EU figures, Britain has pledged £781.2 billion in capital injections, liability guarantees and liquidity support to the banking system. As taxpayers, we're on the hook for any losses.

This is who owns our debt. Currently just over 35% of our national debt is owed to foreign governments and investors. So it's not just Third World nations in hock to the rest of the world. We're relying on the confidence of foreign investors to keep our own country afloat. According to EU figures, Britain has pledged £781.2 billion in capital injections, liability guarantees and liquidity support to the banking system. As taxpayers, we're on the hook for any losses. This is what we spend our money on. In 2010-11, interest payments on the national debt will be the fourth biggest line in the budget, reaching £42.9 billion.

This is what we spend our money on. In 2010-11, interest payments on the national debt will be the fourth biggest line in the budget, reaching £42.9 billion.There is productive and non-productive spending. Public spending is set to rise by £119 billion between 2008 and 2011. Just 6% of this is associated with capital investment. Another 38% is a result of higher social security bills during recession and the dead money of debt interest. This leaves the remaining 56%, which the Government is willfully borrowing to fund yet more unproductive consumption.

Last year national debt interest cost the taxpayer £27.2 billion. In 2010-11 that figure soars to a jaw-dropping £42.9 billion. The more we spend on interest, the less we have to pay down debt or invest for the future. That interest is dead money, which means higher taxes for years to come.

Europe as I see it now

EU DISASTER, UK DISASTER

So last night they met, and they had a nice dinner and a few glasses of wine, and they tried to sort out the money mess that they have got the rest of us into. The EU treaty clearly says that debts must be 3%/60% of GDP, and so far everyone of the EU countries signed up to this has broken the treaty agreement, just shrugging their shoulders at it. So much for treaties. Or lack of oversight by the EU commission and/or EU courts.Can anything change? Well they held the meeting and...

Cameron did NOT use his "veto", he just put a proposal on the table which was not accepted by most other states. We all agree that our debts have to be brought down to manageable levels, and he could have agreed with that. But to insist that the UK finance industry is protected above that of other European countries is unadulterated protectionism and abound to be rejected.

His negotiating tactic also was stupid, he confused this meeting with a meeting of the EU Heads of State under the EU commission aegis, it was not, it was a meeting of countries about their financial crisis - of which UK is a big part!

The first proposal was to have the EU change its treaty to put in the financial policies (debt levels, central financial governance….), this was not agreed by all countries, and not by Cameron without an opt-out clause protecting our finance industry.

So proposal number two was to have a smaller grouping of countries using the euro, and some others who might join the euro some day, and these countries would form a pact to work together.

He did not now have a "veto" at this meeting, just the chance to moan about some special protocols for UK, seeing that the meeting's outcome was not a treaty change for the whole 27 countries of the EU. This idea was now dead in the water.

So, it was not a proposed treaty change for the EU, as other countries did not agree or had to go back and consult. It is just a "private" agreement among those euro countries who signed up, and possibly some others. In this Cameron did not have a "veto" and any request for protection for UK finance industry has no part.

Now he is in dire trouble. He is stupidly supporting the finance industry (against the strong push being made in UK government by the Liberals to support manufacturing, not finance!), he is being pushed by euro-skeptics to demand concessions, but these are not on the table. He is damned if he does and damned if he doesn't. If he back peddles and agrees now to accept the proposals and get them implemented at EU level, then he may have to call a referendum, if he still walks away saying he does not agree, then he has contributed to a two-speed europe, where the UK is in a small minority, on the outside.

Thursday 8 December 2011

Excuse me, but both governments AND banks are guilty

Excuse me but can I ask a question?

How come the banks can loan any amount of money, at an interest rate they demand, to countries that are in contravention of the Maastrich Treaty (3% deficit and 60% debt, to GDP)?Are they totally immoral or, in my belief, illegal in doing so. I really don't see why they should not have just turned round and said to countries outside the parameters of the EU treaty (not just the euro zone!) that they will not extend any more credit. To extend credit outside the limits is to gamble with our sovereignty and I am sure no one of us would agree with that. It was, and is, wrong to believe that they can go on expanding their loans, and thus making more and more profits, from exploiting us, we the people.

Both sides are guilty

So, let's start putting the blame in both places where it belongs. Sure governments (not "politicians", but elected governments) have sought to break the rules and gone about spending that they could not afford, but the banks are equally guilty in making the loans.Tuesday 6 December 2011

Go Cameron, Go

David Cameron, far from being in a noose over the EU and the euro - supposedly tightened by the so-called euro-sceptics, is actually in a great position.

Provided! He grabs this opportunity for the UK to be a strong reforming force in the EU. What do I mean by that?

- He should take a strong stand about the successful future of the EU and the wide adoption of the euro.

- He must avoid the temptation to just do what the city wants, he must do what, us, the people want. Fairness, equality, care… sovereignty of our money…

- He should indicate that, if reforms go ahead and markets are suitable then the UK will join the euro.

- He should "join them" not "stand apart", the UK has a huge amount to offer to the ongoing proposals, we started our efforts to reduce our budget deficit a while ago, others are just starting. His advice on how to go about it is invaluable.

This is the politics of international relations, the USA (including its S&P, Moody's and other rating agencies) is already in decline and no longer able to bully the world over how things should be run. China is budding, but the EU has all the ability to take a leading position in the world. Just let's get it right.

The basic operating methodology of financial markets (mathematical calculation of risk, association of risk and interest, deep levels of CDS on loans…) has to be challenged by governments who are acting for their people. Our sovereignty has an indeterminate value, not a fixed value appointed by financial organisations.

Not that this means governments can run up huge debts, they cannot and must be stopped from doing so. But this has to done throughout the EU not just to sustain the euro as a currency, that is a consequence not a cause. We need to take 20 years to solve the debt problem, not a week that financial markets would like to see to sustain their ridiculous short-term culture.

Provided! He grabs this opportunity for the UK to be a strong reforming force in the EU. What do I mean by that?

- He should take a strong stand about the successful future of the EU and the wide adoption of the euro.

- He must avoid the temptation to just do what the city wants, he must do what, us, the people want. Fairness, equality, care… sovereignty of our money…

- He should indicate that, if reforms go ahead and markets are suitable then the UK will join the euro.

- He should "join them" not "stand apart", the UK has a huge amount to offer to the ongoing proposals, we started our efforts to reduce our budget deficit a while ago, others are just starting. His advice on how to go about it is invaluable.

This is the politics of international relations, the USA (including its S&P, Moody's and other rating agencies) is already in decline and no longer able to bully the world over how things should be run. China is budding, but the EU has all the ability to take a leading position in the world. Just let's get it right.

The basic operating methodology of financial markets (mathematical calculation of risk, association of risk and interest, deep levels of CDS on loans…) has to be challenged by governments who are acting for their people. Our sovereignty has an indeterminate value, not a fixed value appointed by financial organisations.

Not that this means governments can run up huge debts, they cannot and must be stopped from doing so. But this has to done throughout the EU not just to sustain the euro as a currency, that is a consequence not a cause. We need to take 20 years to solve the debt problem, not a week that financial markets would like to see to sustain their ridiculous short-term culture.

Sunday 4 December 2011

Putting PDF slide shows on the iPad

It occurred to me the other day just how good it would due to have the slide shows that I used for training on the iPads of the students.

Now email the PDF file to your iPad, or to yourself if it has the same email address as your computer! When the email arrives click on the attachment PDF and wait while it downloads and opens. Then chose view it in iBooks.

The PDF file will now be in your iBooks PDF collection.

But how?

Well the slide shows are made in Keynote, and can be exported as PDF files. Use File > Print > PDF and Save As… put the file on your Desktop where it is easy to find later.Now email the PDF file to your iPad, or to yourself if it has the same email address as your computer! When the email arrives click on the attachment PDF and wait while it downloads and opens. Then chose view it in iBooks.

The PDF file will now be in your iBooks PDF collection.

Use iTunes sync

Alternatively, add the PDF file directly to your iTunes library, Book section. Go there and check the title and author are ok, then sync your iPad. If you are on iOS5 and iCloud your iPad will sync automatically by WiFi when you plug it into a USB power source.Friday 2 December 2011

Take the winds out of the financial sails

I am not a banker, and they will probably call this fanciful, but I do think we need to take the wind out of bank's sails, and make them subservient to national sovereignty, and better protector of OUR money. So,

Let's cap the interest on sovereign debt, to 4% say for everyone in the EU, and extend it all to 20 years. This means some will pay more (UK, Germany, France…) and some will pay less. Let the central banks smooth that out by issuing money to stop bank failures and by them seeking productive investments, let governments handle it by sweeping tax cuts so people spend.

In addition force fiscal inion of ALL 27 countries, including UK. Restructure the EU, yes I mean the EU, not the euro zone. Integrate more the politics and political decision making, let this control major fiscal policy, allowing freedom for local financing or taxes. But keep the banks small and local to prevent the "too big to fail" problem.

Stop the gambling and interbank shilly shallying. Allow CDS only to first level, but insist backed by secure assets, like gold.

Let's cap the interest on sovereign debt, to 4% say for everyone in the EU, and extend it all to 20 years. This means some will pay more (UK, Germany, France…) and some will pay less. Let the central banks smooth that out by issuing money to stop bank failures and by them seeking productive investments, let governments handle it by sweeping tax cuts so people spend.

In addition force fiscal inion of ALL 27 countries, including UK. Restructure the EU, yes I mean the EU, not the euro zone. Integrate more the politics and political decision making, let this control major fiscal policy, allowing freedom for local financing or taxes. But keep the banks small and local to prevent the "too big to fail" problem.

Stop the gambling and interbank shilly shallying. Allow CDS only to first level, but insist backed by secure assets, like gold.

Tuesday 29 November 2011

1930's sketches at Upton House, near Banbury UK

A Servant's Day Off

This is the time of year for amusements and distractions. As part of Upton House, near Banbury's seasonal attractions the leading local theatre group the Banbury Cross Players will present three 1930's sketches on the 10th and 18th of December 2011.

The sketches will be presented to visitors who wander by in the Long Gallery, The kitchen and the Squash Court of the house. Each will be presented three times a day between 12 noon and 4 pm. The sketches are:

Early Birds by Roland Pertwee, set in the gallery of a provincial theatre, first performed at the Savoy Theatre, London on May 30th 1916

As It Goes Along by Philip Slade, set in a suite of a large hotel, written in 1937

Wireless Cookery by Philip Slade, set in a parlour kitchen, written in 1937

All three sketches will set the scene for your enjoyment of a visit to Upton House, one of the most beautiful in North Oxfordshire.

More information about Upton House and Gardens is on their web site beta.nationaltrust.org.uk/upton-house.

This is the time of year for amusements and distractions. As part of Upton House, near Banbury's seasonal attractions the leading local theatre group the Banbury Cross Players will present three 1930's sketches on the 10th and 18th of December 2011.

The sketches will be presented to visitors who wander by in the Long Gallery, The kitchen and the Squash Court of the house. Each will be presented three times a day between 12 noon and 4 pm. The sketches are:

Early Birds by Roland Pertwee, set in the gallery of a provincial theatre, first performed at the Savoy Theatre, London on May 30th 1916

As It Goes Along by Philip Slade, set in a suite of a large hotel, written in 1937

Wireless Cookery by Philip Slade, set in a parlour kitchen, written in 1937

All three sketches will set the scene for your enjoyment of a visit to Upton House, one of the most beautiful in North Oxfordshire.

More information about Upton House and Gardens is on their web site beta.nationaltrust.org.uk/upton-house.

James and the Giant Peach - theatre production

Grasshopper meets his friends

James and the Giant PeachThrongs of happy children descended on the stage at the Mill Arts Centre, Banbury last week at the end of each performance of Roald Dahl’s James and the Giant Peach, adapted by David Wood.

Invited by Grasshopper to take part in a triumphal march around New York's Central Park, the children came dressed up as one of the insects, Grasshopper, Centipede, Ladybird, Earthworm or Spider. The best dressed were presented with prizes by Grasshopper and everyone went back to their seat with a selection of sweets from James.

Oxfordshire schools had been invited to tell children about the performances and many responded. Both matinee performances were sold out but, more importantly, Banbury Cross Players were delighted to have bought live theatre to 300+ children in the county.

Back to tech things - use of iPhone and iCloud

Using one calendar among all family members

We have a complicated computer usage in our house. I have a Macbook, my wife has a MacBook, I have an iPhone and so does she. I also have an iPad. My son is about to get an iPhone, but he has a PC.The problem is iCloud and synchronising. We have separate and different Apple IDs just as we have different MobileMe email addresses. This on the face of it means that her computer syncs (email, contacts and calendar, apps, books, etc) with her iPhone and mine syncs with my iPhone and iPad.

But what we need is to have one common family calendar, leaving separate mail accounts. So that anyone putting an entry in the family calendar could give notice to any one else. We will also have our son soon as a new iPhone user and we have to see how he will fit in - he has yet another Apple iD/MobileMe email address.

How to solve the problem?

How to get your own synchronised mail & contacts etc, but someone else's calendar? As a pre-requisite set up a calendar on what we will call the "master" machine, in my case my MacBook, and give it a new unique name.Then this is how you do it on the second iPhone:

1 Go to Settings > iCloud > Account and enter your own Apple ID and password for your iCloud account, that will get things synchronising. (If you are coming from Mobile Me then go to iCloud.com and upgrade first)

2 But turn on syncing for everything except calendars.

3 Next go to Settings > Mail, Contacts, Calendars > Add Account, and add the iCloud account of the person who will keep the "master" calendar.

4 Finally, go back to Settings > iCloud > Accounts and now select the "master" persons account name, then turn on Calendars and chose in the calendar app the unique calendar name you set up above on the "master" machine.

The calendar will sync to the "master" account, while your mail and contacts etc will sync to your personal one.

Monday 28 November 2011

Help, please... the euro is failing, we need to save it

Am I a lone voice of the people?

The euro

We want the euro to continue to exist, we like it very much. So politicians stop fussing, take control of our money, sort out the banks (let them go banckrupt, protecting our money) or have the ECB finance them as the USA Fed does. Couple this to a 27 member agreement to use the euro, and for everyone to have binding fiscal policies to protect its future. Just get on with it. We can't have growth and jobs unless people have the money to buy goods, and they dont.More money to spend

The question is why? More money has to be put in people's pockets, through higher wages, lower debts and smaller household running costs. UK wages are a pittance and businesses have to recognise that paying lower wages gets you monkeys, to grow you need geniouses and these cost.And invest

Why does industry not invest? Last April to government announced a £2.5bn find, of which only £8m has been taken up? There are two simple reasons, consumers are not buying becaseu they have no money, and industry is incompetent to make the things people want, people in any part of the world. The first reason is true for UK and parts of Europe, the second is true universally. Managers and Entrepreneurs have to get off their backsides, have courage and leap into business. I am not interested in working out the details, and being shouted down by financiers self protecting! Let's agree the principles and, whatever the cost, do it.Sunday 27 November 2011

What happens naturally - bankruptcy

The farce is over

At last I have seen the first press commentary about the banking/euro crisis (they are really the same thing). You see, what happened was:- Countries borrowed too much and spent ridiculously more than they could ever pay back. Sovereign value has a limit, a big one but a limit.

- and on the contrary, banks loaned more than they could expect to get back, ignoring prudence and over leveraging themselves, effectively devaluing the money they are in business to prosper.

Guilt

Both sides are equally guilty of causing this crisis, and both side have to solve it. So far banks are pretending they are blameless, just lending countries what they need provided the return is right. The problem of this is a return of 7% or more cannot be repaid after a certain time when the total outstanding debt is 120% or so of GDP.On the other side, countries went on a spending, or ridiculous social support, binge. They borrowed to prop up social systems that were poorly thought out and too expensive. They made bad investments in national industries that could never give a return. In other words they paid us all to not have to work.

Bankruptcy

And now the moment has come: why not bankruptcy? OK so both sides lose but that is the correct and natural way of finance, not the 'kicking the can down the roda' sticking plaserts we have seen for months. Let's just get on with it and see if we could possibly manage it smoothly. Get the real value back in our money, get the banks to stop derivative gambling, stop people over-extending themselves with mortgages they can't afford and seems of credit cards in their wallets.Friday 25 November 2011

Stop making things complicated

It s about time we all, and with great emphasis the bankers, stopped making the euro crisis complicated.

* There are big debts, both you and me, and back and forth between countries. We must acknowledge our personal as well as government debts. We have to pay off the first, our taxes and government spending cuts have to pay off the second. Double whammy, but we got ourselves here...* There is a banking system out of democratic control and doing what they like, in the aid of none of us. We do not have laws which sensibly govern the city of london, and all the other world centres of finance. This needs to be fixed globally. A big challenge but until we do it there will always be someone who makes a fast buck.

* There is the euro to save, all the people want it, it is a forgone democratic choice. We need stable, valuable money. Not money whose value and predictability is at the whim of a very small group of financiers. The EU is now based on a common currency, break one you break the other. Moreover it is time to consolidate the EU and have all 27 members use the euro.

* We have wealth. In our countries and in our people. Much bigger than simple debts can say. Just look at our level of social cohesion, our stable and democratic governance, our value and beliefs, our patrimony, our technology… we are an advanced society. This has immense value and must not be put at risk by a bad money system

So what to do?

The fundamental problem lies at the door of banks. They loaned too much to people who cannot pay, they constructed excessively complicated "instruments" and "products" to gamble with other people's money (yours and mine). They confused returns and risk and played games with these.The banks have to be changed to be simple, guardians of our money, and careful investors in stable things that can give us all decent returns. Banks must learn to live within the extent of their loans, for example house values are a risk for the lender as well as the borrower: the market goes down, the equity goes down, the repayments go down… and vice versa.

European governments have to take strong and relentless control of banking, even up to the point of nationalising the lot. They have to redefine the real purpose of money, to trade and invest in society's development.

Next, we all have to stop deluding ourselves, stop or governments spending on projects which have political, but not economic value (take PFI as a stupid example of government mis-management). But also, very importantly, we have personally to pay our debts. It is not enough to want to buy a house or a home we have also to realise that this is a debt that has to be paid. And add that to other loans, on credit cards etc, we must understand that we can be over-extended and at risk of not being able to pay back. We must learn the lesson to live within our means.

Put simply

Give money a real purpose (gold standard anyone?). Pay debts (or write them off ?).

Wednesday 23 November 2011

Government subsidies for building houses are wrong.

What a stupid policy! Financing by government aimed at stimulating the housing building business. Thus creating more and more sub-prime mortgages. The policy will simply mean more money in the pockets of builders, more people over-extended with debt and banks excused the risks of lending.

What needs to happen is quite different.

Lower prices for houses and land.

Simply house prices have to come down. Houses cost £40,000-£70,000 to build, and they could cost even less with factory made, mass production pre-fabricated designs. But the land to build them on costs up to twice as much. So it is land prices that have to come down. Councils that own land and want houses built on it, have to realise that they cannot sell it for ridiculous prices. If they want to house people they have to give away the land to do so.

Bank risk

Add this to banks having a new policy, strategy, call it what you will. A bank loans £100,000 to buy a home. The home equity falls in a slump to £80,000. The home owner is now in negative equity and has taken 100% of the risk in buying the house. The bank still demands the full repayment of £100,000! This has to stop, the risk has to shared, so that the amount to pay back goes down if the market falls (and up of course if it rises…) and the bank has to dynamically re-value the loan and take some risk.

What needs to happen is quite different.

Lower prices for houses and land.

Simply house prices have to come down. Houses cost £40,000-£70,000 to build, and they could cost even less with factory made, mass production pre-fabricated designs. But the land to build them on costs up to twice as much. So it is land prices that have to come down. Councils that own land and want houses built on it, have to realise that they cannot sell it for ridiculous prices. If they want to house people they have to give away the land to do so.

Bank risk

Add this to banks having a new policy, strategy, call it what you will. A bank loans £100,000 to buy a home. The home equity falls in a slump to £80,000. The home owner is now in negative equity and has taken 100% of the risk in buying the house. The bank still demands the full repayment of £100,000! This has to stop, the risk has to shared, so that the amount to pay back goes down if the market falls (and up of course if it rises…) and the bank has to dynamically re-value the loan and take some risk.

I have to laugh at Samsung's product offering

There are a couple of photos which illustrate Apple's whole philosophy about products: build it right and the best you can.

Compare this to the myriad models of junk from Samsung, a lot of them trying to mimic Apple…

Samsing's offering

Apple satisfies customer needs and wants with a well designed product, Samsung seems not to have any idea about what to offer and just let's its nerds go ahead and make multiple mistakes.

I know that if I was a retailer then whose product lineup I would chose, easy to sell, easy to support, good for my reputation.

Compare this to the myriad models of junk from Samsung, a lot of them trying to mimic Apple…

Samsing's offering

Apple satisfies customer needs and wants with a well designed product, Samsung seems not to have any idea about what to offer and just let's its nerds go ahead and make multiple mistakes.

I know that if I was a retailer then whose product lineup I would chose, easy to sell, easy to support, good for my reputation.

Friday 18 November 2011

A few Financial numbers and scenarios

Thanks to the internet - especially zerohedge.com - for these diagrams.

First a comparative size chart of some of the big numbers, to get us just into the right frame of mind.

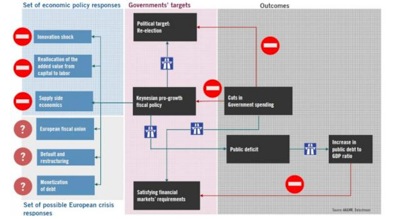

Next a lovely chart showing the position of various economies in terms of public debt.

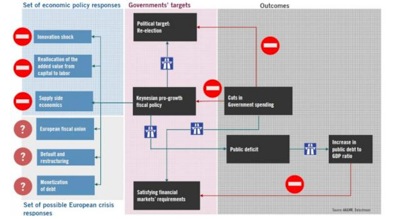

Now what will governments do? They have strangely different motivations from you or I, surely not why we elected them to solve the crisis?

And finally a set of scenarios for the resolution of the euro crisis. I favour the top one of these, fiscal union, but including all 27 EU members. That should fix the problem! I believe we have to take back the meaning of money from the wild gambling financiers - who are still continuing to play there games throughout the crisis, god knows why.

First a comparative size chart of some of the big numbers, to get us just into the right frame of mind.

Next a lovely chart showing the position of various economies in terms of public debt.

Now what will governments do? They have strangely different motivations from you or I, surely not why we elected them to solve the crisis?

And finally a set of scenarios for the resolution of the euro crisis. I favour the top one of these, fiscal union, but including all 27 EU members. That should fix the problem! I believe we have to take back the meaning of money from the wild gambling financiers - who are still continuing to play there games throughout the crisis, god knows why.

Tuesday 15 November 2011

Please take the EU forward

I am a dedicated "EU-file". Not only the EU as a political and organisational institution but also the need for a common currency, just like open boarders.

I believe that ALL the members of the EU should use the same currency, and have open boarders. UK included. It is wrong for us to be part of the EU but compete against it with our own currency which we can manipulate to gain unfair competitive advantage.

There are two key problems our leaders have to solve:

One way to do this which I have advocated is to merge local politicians and parliaments with the EU parliament in Strasburg. With the SAME MPs sitting in both. Or at least a large percentage of Westminster MPs having a dedicated responsibility to sit in the EU parliament. To merge elections, when you vote for an MP you vote for his local and his EU policies.

And, while we are at it, let's define what money is NOT for: it is not for creating an entirely fictitious "financial industry" with "financial products" that enable people to take huge wagers using money they do not own.

In the mean time let's stop all this bullshit about bond prices and deficits. Put a ceiling on the yield that can be paid, and let countries and banks live with the consequences of being able or not to raise the money they think they want to spend or earn. The cycle of government profligacy and market extortion has to be broken.

I believe that ALL the members of the EU should use the same currency, and have open boarders. UK included. It is wrong for us to be part of the EU but compete against it with our own currency which we can manipulate to gain unfair competitive advantage.

There are two key problems our leaders have to solve:

ONE

Strengthening the democratic management of the EU. We have passed the time when it is enough to have a technocratic management, with weak political oversight by government leaders. We need true, strong parliamentary governance and institutions, an EU civil service if you like.One way to do this which I have advocated is to merge local politicians and parliaments with the EU parliament in Strasburg. With the SAME MPs sitting in both. Or at least a large percentage of Westminster MPs having a dedicated responsibility to sit in the EU parliament. To merge elections, when you vote for an MP you vote for his local and his EU policies.

TWO

We have to have a common money. Let's first define the simple purpose of money. It is to enable the exchange of goods, as a replacement of bartering, it is for us to be paid for endeavours, and it is for our choice to invest in productive ventures to provide better goods and services.And, while we are at it, let's define what money is NOT for: it is not for creating an entirely fictitious "financial industry" with "financial products" that enable people to take huge wagers using money they do not own.

LEADERSHIP GOALS

What seems quite simple to me, seems to be an insurmountable problems for today's leaders. Perhaps they should step back, listen and find a way to get these two goals in place.In the mean time let's stop all this bullshit about bond prices and deficits. Put a ceiling on the yield that can be paid, and let countries and banks live with the consequences of being able or not to raise the money they think they want to spend or earn. The cycle of government profligacy and market extortion has to be broken.

Wednesday 26 October 2011

Why is Europe in this mess?

First monetary union, as implemented without political union, was a reckless gamble:

- single interest rate

- single exchange rate

- single inflation target

was meant to cement together 17 countries with utterly different economic performance!

Single interest rate

Some countries found that the cost of borrowing fell even when there was the risk of the economy overheating, but could do nothing about it. E.g Ireland when the 2009 boom was driven by reckless lending of banks.

Single exchange rate

Italy, Greece, Spain, Portugal, etc found that they could not match Germany's efficiency, and over time their exports became less and less competitive.

No way to deal with problems

The euro had no way to deal with different country's performance. There are three ways countries could handle this…

1 Unemployed workers move to where there are jobs. But language barriers and housing/social problems prevent this in Europe

2 Money can move to where the unemployed workers are. But sovereign states with no federal control didn't do this.

3 Workers take pay cuts until the goods they produce become competitive.

So number 3 was the only way out, and you can see the problems this is causing in cuts in living standards across Europe. Even UK is not unaffected.

Issues

Europe has no finance minister with tax and spending powers to move resources around. It needs to change the political and institutional structures towards a fiscal union. UK fears this as it would be on the outside… Also voters do not want this, but contradictorily they do not want the euro breakup.

So the policy makers have wasted 4 years kicking the can down the road.

Long term?

There are 27 members in the EU. Long term the only solution is for them ALL to adopt a common currency and have a common fiscal policy. Like the USA. History shows that monetary unions either develop into political unions or they collapse.

We have a fledgling European parliament, now is the time to focus on this at the expense of local parliaments. In UK Westminster HAS to turn its attention to Strasburg, and get more involved, even conceding more powers, quite the opposite of the current political feelings.

So what I advocate is a merger of the people in politics, the same people should be elected by us and sit in both Westminster AND Strasburg to develop a EU-wide governance.

- single interest rate

- single exchange rate

- single inflation target

was meant to cement together 17 countries with utterly different economic performance!

Single interest rate

Some countries found that the cost of borrowing fell even when there was the risk of the economy overheating, but could do nothing about it. E.g Ireland when the 2009 boom was driven by reckless lending of banks.

Single exchange rate

Italy, Greece, Spain, Portugal, etc found that they could not match Germany's efficiency, and over time their exports became less and less competitive.

No way to deal with problems

The euro had no way to deal with different country's performance. There are three ways countries could handle this…

1 Unemployed workers move to where there are jobs. But language barriers and housing/social problems prevent this in Europe

2 Money can move to where the unemployed workers are. But sovereign states with no federal control didn't do this.

3 Workers take pay cuts until the goods they produce become competitive.

So number 3 was the only way out, and you can see the problems this is causing in cuts in living standards across Europe. Even UK is not unaffected.

Issues

Europe has no finance minister with tax and spending powers to move resources around. It needs to change the political and institutional structures towards a fiscal union. UK fears this as it would be on the outside… Also voters do not want this, but contradictorily they do not want the euro breakup.

So the policy makers have wasted 4 years kicking the can down the road.

Long term?

There are 27 members in the EU. Long term the only solution is for them ALL to adopt a common currency and have a common fiscal policy. Like the USA. History shows that monetary unions either develop into political unions or they collapse.

We have a fledgling European parliament, now is the time to focus on this at the expense of local parliaments. In UK Westminster HAS to turn its attention to Strasburg, and get more involved, even conceding more powers, quite the opposite of the current political feelings.

So what I advocate is a merger of the people in politics, the same people should be elected by us and sit in both Westminster AND Strasburg to develop a EU-wide governance.

Tuesday 25 October 2011

The real Europe

Take note of this:

1 Only 7% of UK laws come from Europe, and most directives are just common sense.

2 We pay £9bn in tax to EU, but most of it comes back as agricultural support. We paid £10bn to the IMF to recycle to the Eurozone!

3 The EU is democratic. Commission decisions are taken by Council of Ministers, with UK present. MEPs are elected and have powers over regulations and laws. UK parliament needs to get more involved with EU decision making…

4 The CBI and multinationals have BIG lobbying presence in the EU and help to write the directives.

5 It is British judge's interpretations of the UK Human Rights Act that are in dispute, not the EU ECHR. The ECHR is anyway a Treaty so applies whether we are in or out of the EU.

6 We cannot survive by exporting to the world without the EU. The EU market is open to us, and worth £16tn

7 Even outside the EU we would have to follow their rules if we want to sell there.

8 The EU is not interested in Cameron's political problems. But every country has the same issues and wants to see a different EU, this is the name of the game for an active union.

1 Only 7% of UK laws come from Europe, and most directives are just common sense.

2 We pay £9bn in tax to EU, but most of it comes back as agricultural support. We paid £10bn to the IMF to recycle to the Eurozone!

3 The EU is democratic. Commission decisions are taken by Council of Ministers, with UK present. MEPs are elected and have powers over regulations and laws. UK parliament needs to get more involved with EU decision making…

4 The CBI and multinationals have BIG lobbying presence in the EU and help to write the directives.

5 It is British judge's interpretations of the UK Human Rights Act that are in dispute, not the EU ECHR. The ECHR is anyway a Treaty so applies whether we are in or out of the EU.

6 We cannot survive by exporting to the world without the EU. The EU market is open to us, and worth £16tn

7 Even outside the EU we would have to follow their rules if we want to sell there.

8 The EU is not interested in Cameron's political problems. But every country has the same issues and wants to see a different EU, this is the name of the game for an active union.

Sunday 16 October 2011

Banbury Cross Players - next production

Event Details

- Type:Production

- Group: Banbury Cross Players

Address

- Address: Mill Arts Centre, Spiceball Park, Banbury

Contact Details

- Contact:: Mill Arts Centre 01295 279 002, www.themillartscentre.co.uk

Extra Information

- Other Information: Roald Dahl’s James and the Giant Peach adapted by David Wood Directed by Jane Young

17-19 Nov 2011 7.45pm, 19 Nov 2011 2pm, 24-26 Nov 2011 7.45pm, 26 Nov 2011, 2pm £8.50 / £7.50 all performances

Life is hard for orphan James until a mysterious stranger arrives with a bag of magical crystals... What happens next is for you to find out. Come and join James and his friends - Grasshopper, Centipede, Ladybird, Earthworm and Spider - as they go on a juicy journey using their individual skills to save the giant peach from marauding sharks, a giant octopus and a very tricky landing in New York.

Saturday 8 October 2011

Needed - a data stream

We have had email for years, attachments for years. FTP data transfer for years. We have streaming music, and streaming video.

But I would like to suggest we need "pipes". A way of streaming data, from any app running on any machine to any app running 100miles away on another.

A kind of transparent unix pipe running over WiFi, ADSL, 3G. I call it DataStream, and like Apple's Airplay it has to be utterly simple to set-up and use.

So my computer friends, get to it.

But I would like to suggest we need "pipes". A way of streaming data, from any app running on any machine to any app running 100miles away on another.

A kind of transparent unix pipe running over WiFi, ADSL, 3G. I call it DataStream, and like Apple's Airplay it has to be utterly simple to set-up and use.

So my computer friends, get to it.

The Simple Truth - Financial crisis

From the Guardian

Talking about a general trend and view of the world which has gone astray.

The point is, today everyone can see that the system is deeply unjust and careening out of control. Unfettered greed has trashed the global economy. And we are trashing the natural world. We are overfishing our oceans, polluting our water with fracking and deepwater drilling, turning to the dirtiest forms of energy on the planet, like the Alberta tar sands. The atmosphere can't absorb the amount of carbon we are putting into it, creating dangerous warming. The new normal is serial disasters: economic and ecological.

The task of our time is to turn this round: to challenge this false scarcity. To insist that we can afford to build a decent, inclusive society – while at the same time respect the real limits to what the earth can take.

Talking about a general trend and view of the world which has gone astray.

The point is, today everyone can see that the system is deeply unjust and careening out of control. Unfettered greed has trashed the global economy. And we are trashing the natural world. We are overfishing our oceans, polluting our water with fracking and deepwater drilling, turning to the dirtiest forms of energy on the planet, like the Alberta tar sands. The atmosphere can't absorb the amount of carbon we are putting into it, creating dangerous warming. The new normal is serial disasters: economic and ecological.

The task of our time is to turn this round: to challenge this false scarcity. To insist that we can afford to build a decent, inclusive society – while at the same time respect the real limits to what the earth can take.

Thursday 6 October 2011

Steve

What can I say. I have admired Steve Jobs for as long as I have adopted and used Apple products, twenty years or so.

This one man changed everything and gave us computer and media products which were in every way better than anything known or conceived before.

Good Bye, Steve and thank you

This one man changed everything and gave us computer and media products which were in every way better than anything known or conceived before.

Good Bye, Steve and thank you

Friday 30 September 2011

Green progress - good

Growing renewable electricity - amazing numbers

From the Guardian.Renewable electricity contributed an all time high of 9.6% of the UK's grid mix in the second quarter of this year, statistics released on Thursday by the Department of Energy and Climate Change have revealed.

The 7.86TWh (terawatt hours) contributed by green energy generators represented a 50% rise on the same time last year.

The surge in green energy was led by the wind energy sector, which saw output rise 120% year on year, and hydroelectricity where output rose 75% year on year.

Nuclear energy also saw a large rise, increasing by 38% to 17.44TWh, making up 21% of the UK's overall supply, its highest since 2006. The performance put nuclear on a par with coal, which recorded 18.14TWh of output, making up 22% of all electricity generated.

Gas still made up 44% of UK electricity supply, but this was well down on last year's 53%. Gas output fell 18.3% to 36.37TWh.

Total electricity supplied by all generators in the second quarter of 2011 was 1.7% lower than a year earlier, while final consumption of electricity fell by 1.6%. Showing we have a long way to go in saving energy...

New future

More and more I believe that government does not see, or wish, to see the future.

First HS2 then 80MPH speed limits. Physically rushing about. Claimed to save time = save £ millions.

But 80MPH is not the future. The future is in moving around, electric vehicles, much more tele-working ( needing those billions to be spent on broadband infrastructure).

But here is the good news, the increase in the number of 20MPH limits. Let's hope this does not just mean more speed bumps!

The real issue is the redesign of cars so that they go easily at 20 MPH and can barely reach 80-90MPH. Smaller engines? Different gear ratios? Cruise control (up to max, or at chosen speed limit) And maybe a more rational approach, 20, 40, 60 and 80 limits for residential, rural & B, A roads, Motorways?

Economics

Credit...credit...credit. Debt...debt...debt. Toy money flooding around in casino banking. Credit flooding around in high mortgage lending and high/easy credit card spending.

Time to restore the real purpose of money, to trade and for productive investment. Every one says we need to restore industry, invest more. But no one is doing the obvious and suppressing the casino financiers, to divert money into industry and savings.

Transport and economics are a couple of cases

TransportFirst HS2 then 80MPH speed limits. Physically rushing about. Claimed to save time = save £ millions.

But 80MPH is not the future. The future is in moving around, electric vehicles, much more tele-working ( needing those billions to be spent on broadband infrastructure).

But here is the good news, the increase in the number of 20MPH limits. Let's hope this does not just mean more speed bumps!

The real issue is the redesign of cars so that they go easily at 20 MPH and can barely reach 80-90MPH. Smaller engines? Different gear ratios? Cruise control (up to max, or at chosen speed limit) And maybe a more rational approach, 20, 40, 60 and 80 limits for residential, rural & B, A roads, Motorways?

Economics

Credit...credit...credit. Debt...debt...debt. Toy money flooding around in casino banking. Credit flooding around in high mortgage lending and high/easy credit card spending.

Time to restore the real purpose of money, to trade and for productive investment. Every one says we need to restore industry, invest more. But no one is doing the obvious and suppressing the casino financiers, to divert money into industry and savings.

Thursday 29 September 2011

Money

Excuse me but where did all this lending come from?

The irresponsible banks.This is not a social problem but a political problem as much as they failed to regulate banks, It is a banker problem, they over extended loans without evaluating the risk. Now the risk has caught up with both lenders and borrowers. But if the banks, who in the first place provided the money, had refused to lend it, then the crisis would not have happened.

Greece, and all the rest of the world and you and me, would not have been able to run up debts and would have been forced to live within its means. In other words, if we want something we would have to save up for it, or make a good business case for our desired investment, staying within our ability to pay.

So let me repeat, this is primarily a bankers irresponsible problem, second a political problem. It is clear what bankers should have done: refused the loans, not bought the bonds, etc

What should politicians have done?

- limited credit overall within a sensible money supply, not permit ficticious money to allow casino banking- set up a firm basis for a common euro currency, and even making this a condition of EU membership

UK note, you should be in, not out. If you think it is clever to stay out, you are weak and refuse to meet the challenge of creating a sensible new currency. Bugger the City, forget huge Treasury income from financiers. Focus on making money do what it is supposed to do for people (trading) and businesses (investing)

So who will sort out the mess? And at what cost to whom?

The way it is balanced just now is that irresponsible bankers, who remember are at the top of the causes pile, will again get bailed out at the expense of sucking yet more taxes out of ordinary citizens. And this is not right. A balance is needed.For sure we have all indulged in borrowing which in reality we cannot afford to pay back, for example ever longer mortgages, on ever more inflated house prices. But banks have encouraged this, and extended vast amounts to our credit cards, which we have found just too easy to resist, even if we could not pay it back.

So we have to return to real values for money. And money, not credit, has to be the basis of ort economic activity. This means cancelling debts, removing them from our books, redefining the value of money, severely regulating the financial people.

And by the way it is not a "financial industry with products", it is not an industry, it is banking, investing, not gambling. Why do we, even now, quietly accept the way the financiers act as simple casino banking or gambling, with our money.

Because money belongs to us. It is issued by governments to people to trade and invest. Not to bankers to gamble.

Action

- make a 10-20 year debt write off plan for governments an banks, AND people- allow only government borrowing equal to business investment

- allow personal borrowing up to a maximum % of income (two limits, secured i.e mortages, and unsecured, everything else)

Wednesday 21 September 2011

Confused about debt and deficit

I find it very difficult to

1 Find out the actual data of debt and deficit of european countries

2 See how on earth almost all euro countries are breaking the Maasricht treaty!

* Inflation not greater than 1.5% points above the average of the 3 lowest countries

* Deficit/GDP less than 3%

* Debt/GDP less than 60%

* Long term interest rates not more than 2% higher than the 3 least inflation countries

As far as the deficit is concerned I have little data, but in 2009 Greece was 13.6%, UK 11.5%. France was 7.5%… Again some big players breaking the rules by BIG margins.

Wouldn't it be nice to have a simple table showing Debt/GDP, Deficit/GDP, Inflation, Debt in euro (including government, banks, individuals and any hidden stuff like the UK's PFI)?

1 Find out the actual data of debt and deficit of european countries

2 See how on earth almost all euro countries are breaking the Maasricht treaty!

The Treaty

When the euro zone was set up their were entry requirements, and it was assumed that these would continue to be met. They are:* Inflation not greater than 1.5% points above the average of the 3 lowest countries

* Deficit/GDP less than 3%

* Debt/GDP less than 60%

* Long term interest rates not more than 2% higher than the 3 least inflation countries

A few things I have found

The worst debt/GDP is in Greece, in 2010 this was 143%. The figure for UK, not in the euro zone, was 76%… The strong men of Europe, Germany and France had 83% and 82% respectively. Spain and Italy were 60% and 119%, Ireland was 97% and Portugal 93%. In other words only Spain was at the limit, all others had broken the rules. And their governments had done nothing about it.As far as the deficit is concerned I have little data, but in 2009 Greece was 13.6%, UK 11.5%. France was 7.5%… Again some big players breaking the rules by BIG margins.

Wouldn't it be nice to have a simple table showing Debt/GDP, Deficit/GDP, Inflation, Debt in euro (including government, banks, individuals and any hidden stuff like the UK's PFI)?

Sunday 18 September 2011

Money Realisation?

Thanks for this by Will Hutton in the Guardian:

"Eighty years ago, faced with today's economic events, nobody would have been in any doubt: we would obviously be living through a crisis in capitalism. Instead, there is a collective unwillingness to call a spade a spade. This is variously a crisis of the European Union, a crisis of the euro, a debt crisis or a crisis of political will. It is all those things, but they are subplots of a much bigger story: the way capitalism has been conceived and practised for the last 30 years has hit the buffers. Unless and until that is recognised, western economies will be locked in stagnation which could even transmute into a major economic disaster.

Simply put, the world has trillions upon trillions of excessive private debt financed by too many different currencies whose risk is allegedly mitigated by even more trillions of financial bets which in aggregate do not minimise the systemic risk one iota. This entire financial edifice, underwritten by tiny amounts of capital, has been created over three decades backed by the theory that markets do not make mistakes. Capitalism is best conceived and practised, runs the theory, by hunter-gatherer bankers and entrepreneurs owing no allegiance to the state or society."

So

1 Excessive private debt. Banks owns to states, banks loans to you and me, our credit cards, our mortgages. Live now!